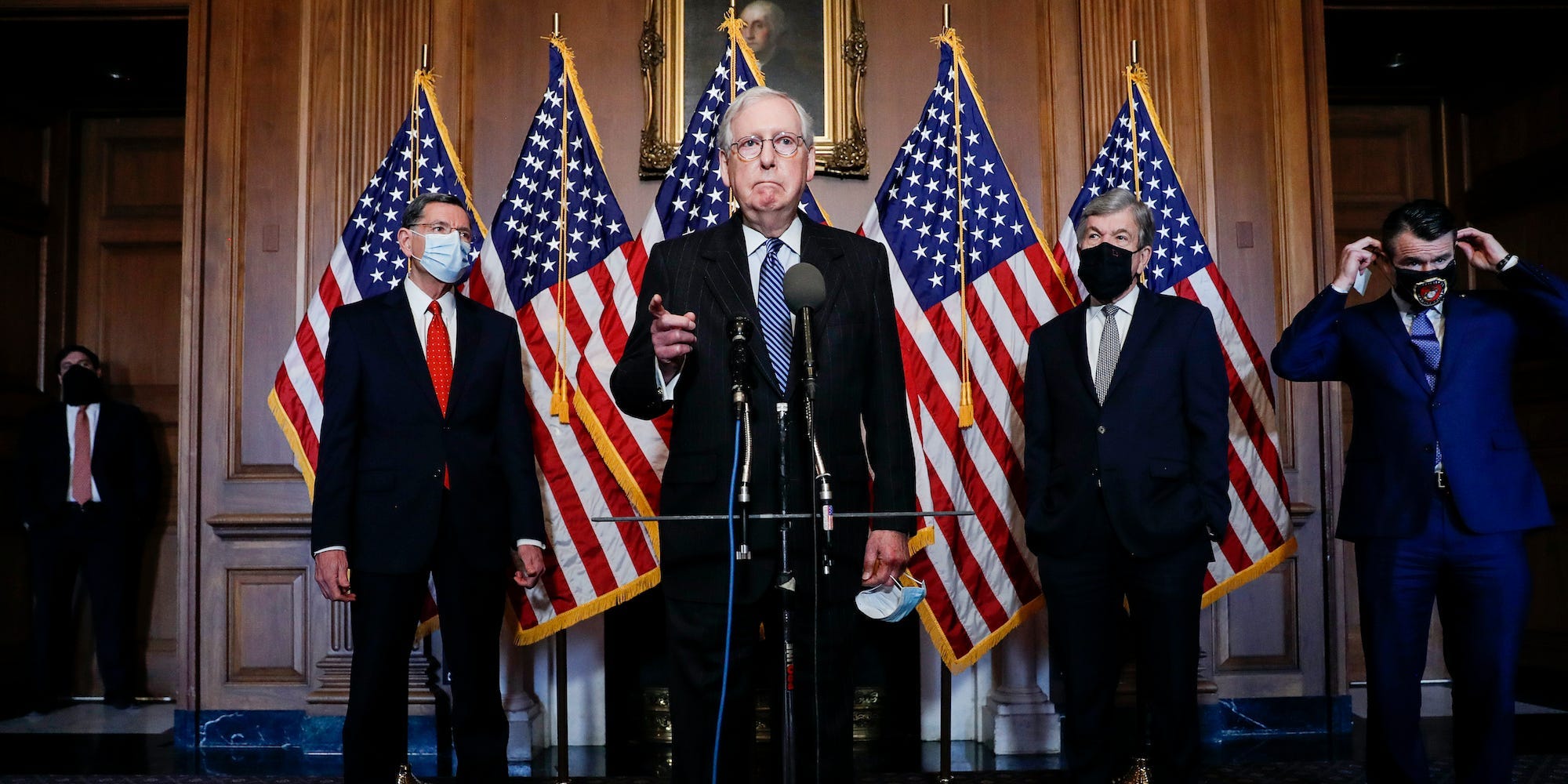

Tom Brenner/Pool via AP

- Republicans reintroduced a bill to repeal the estate tax, which affects less than 2,000 households.

- The GOP lawmakers claim this will help farm estates, but USDA data show only 0.6% would be affected.

- This legislation comes eight days after Democrats introduced an ultramillionare tax.

- See more stories on Insider's business page.

Eight days after the Democrats introduced an ultramillionaire tax proposal on the richest American households, Republican lawmakers proposed less taxes on the wealthy by means of a federal estate tax repeal.

The estate tax is a tax on a person's right to transfer property after death, but it only applied to estates valued at over $11.7 million in 2021. A 2020 estimate by the Tax Policy Center found that fewer than 2,000 households would have to pay the estate tax in 2020, given this high threshold. But Republican Sens. John Kennedy of Louisiana and John Thune of South Dakota want to permanently repeal all of that with their Death Tax Repeal Act of 2021.

"The death tax is lethal to many family-run businesses and farms," Kennedy said in a statement. "Louisianians shouldn't lose a legacy of family work to a punishing, illogical tax burden. By ending the death tax, we can make it easier for families to pass their farms and businesses to the next generation."

-Senator John Thune (@SenJohnThune) March 9, 2021

However, data from the Dept. of Agriculture revealed that farm estates did not actually bear much of the brunt of estate taxes. In 2020, the USDA forecasted that only 0.6% of the 31,394 farm estates would be required to file an estate tax return, and only 0.16% of those estates would have an estate tax liability.

Thune and Kennedy did not immediately respond to Insider's request for comment.

The Republicans' legislation came after Democrats introduced an ultramillionaire tax on the top 0.05% of Americans households on March 1, led by Sen. Elizabeth Warren of Massachusetts, which would place a 2% tax on household net worth between $50 million and $1 billion and a 3% tax on household net worth over $1 billion.

"A wealth tax is popular among voters on both sides for good reason: because they understand the system is rigged to benefit the wealthy and large corporations," Warren said in a statement.

Taxing the wealthy has often been a partisan issue in Congress. During a speech in 2017, former President Donald Trump called the federal estate tax a "tremendous burden" on family farmers and said he would not allow "the death tax or the inheritance tax or the whatever-you-want-to-call-it to crush the American Dream."

The reintroduction of the tax repeal also comes as President Joe Biden signed his $1.9 trillion stimulus into law on Thursday, offering significant assistance to low-income families while cutting out those earning above $80,000 from receiving $1,400 stimulus checks.

"To Speaker Pelosi, Majority Leader Schumer, and everyone who voted for the American Rescue Plan - thank you," Biden said on Twitter on Wednesday. "This is a historic victory for the American people."